Brookfield Asset Management

Our Business Today

We manage over $1 trillion of assets within long-term private funds, perpetual strategies, permanent capital vehicles and liquid products across five key verticals. Our structure provides access to all major pools of capital while supplying a range of investors with tailored approaches to meet their objectives.

Investment Approach

We have a long heritage of successfully owning and operating businesses, and this has always been an important driver of our success—and now more so than ever.

Acquire high-quality assets and businesses

We invest in the backbone of the global economy, so when it changes, we adapt with it. Years ago, we invested heavily in railroads and ports; today we’ve added a focus on data centers and the energy needed to power the latest technological deveopments. While the assets that form the backbone of the global economy may change, our focus remains the same: investing in what keeps the world moving, today and tomorrow.

Invest on a value basis to grow cash flow and compound capital

Our proven ability to raise capital—consistently and at scale—stems from our deep relationships with the world’s leading institutions, a growing global private wealth network, a diversified product suite, and strong alignment with the permanent capital of Brookfield’s public affiliates.

Enhance value through operating expertise

With over a century of real asset experience, we take a uniquely hands-on approach to value creation—enhancing productivity, improving margins, and optimizing capital structures. This operational focus is core to our ability to deliver consistent, long-term outperformance.

Build sustainable, inflation-linked cash flows to lower risk and funding costs

We follow a proven blueprint: invest behind long-term themes supported by durable tailwinds, build conviction through insights from the Brookfield Ecosystem, and seek attractive entry points where we can create lasting value.

Reallocate free cash to the highest-return opportunities

By investing in the right sectors, raising capital at scale, deploying it with discipline, and operating with excellence, we deliver strong, risk-adjusted returns. These results build trust, scale our funds, grow our business, and propel a powerful cycle of long-term value creation.

Our Portfolio

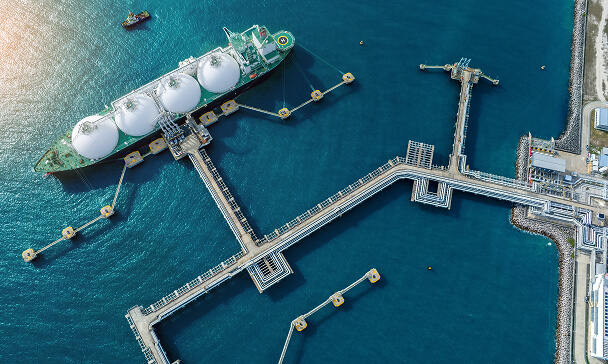

Infrastructure

Leading infrastructure strategy

We are one of the largest investors in global infrastructure, delivering essential services that support modern economies. Our diversified portfolio, grounded in over 125 years of investment experience, spans the utilities, transport, midstream, and data sectors. These assets offer principal safety, inflation-linked cash flows, and long-term value creation. As global supply chains shift, data demand surges, and infrastructure needs outpace government budgets, private capital is critical.

Renewable Power & Transition

Largest global transition platform

We have a longstanding leadership position at the forefront of the global transition to sustainable energy. We own, operate, and develop one of the world’s largest renewable energy portfolios, spanning renewables, energy storage, and a range of sustainable solutions. We use our operating capabilities, scale and global reach to develop and maintain a high-quality clean energy portfolio in a responsible manner, helping accelerate the global transition to net zero and drive the energy transition forward.

Private Equity

Best-in-class private equity platform

Born out of our real asset operating heritage, we are a global leader in acquiring and driving operational transformation in industrials and essential business services. We take a hands-on approach to value creation and operational improvement, partnering with management teams to enhance profitability, bolster operations, and position businesses for sustainable growth. Excellent results across our flagship funds for over 25 years.

Real Estate

One of the largest global real estate investors

We are one of the largest and most successful global real estate investors, with a diversified portfolio spanning housing, office, retail, logistics, and hospitality We buy, build and actively manage institutional-quality real estate companies, platforms and properties.. Our portfolio includes some of the most iconic properties in the world’s leading cities. We take a hands-on approach to asset management, with a legacy spanning more than a century and a reputation for delivering value through all market cycles.

Credit

Unmatched credit capabilities across funds and partnerships

Our credit platform spans asset-based finance, opportunistic credit, and direct lending—delivered through a diverse suite of fund strategies and partnerships with leading managers. We leverage our scale, relationships, and deep operating insight from our equity businesses to enhance sourcing and underwriting—giving us a powerful edge across the same asset classes where we already invest and operate.